There’s a phrase that has been overused in the boardroom – “Cashflow is the king.” However when your business is powered by multiple disjointed systems, you see a different scenario. You see that your team is spending a significant amount of man-hours on manual data entry. That’s when you realize that your cash flow king has lost its royalty!

What if your orders could flow seamlessly from your eCommerce platform straight to invoicing without a single manual touchpoint? What if you could slash days—not just hours—from your revenue cycle?

That’s not wishful thinking. It’s exactly what businesses like Henri Lloyd are achieving with APPSeCONNECT’s ERP integration and order to cash automation.

What Is ERP Order-to-Cash Automation & Why It Matters

The order to cash process is a process encompassing every step from when you receive an order from your customer till the time you receive the amount paid by the customer. Thus, the order-to-cash process includes:

- Customer placing an order

- Order processing, fulfillment, and inventory management

- Shipping and delivery

- Invoicing, payment collection, and revenue recognition

As you can see, terming order-to-cash as a single process is wrong. The stages in O2C are in themselves separate processes that are handled by different departments in your organization. For most businesses, O2C spans multiple systems used by an enterprise:

- Ecommerce platform (or POS, when it comes to offline channels)

- ERP system

- Warehouse manage system

- Payment processors

When these independent systems work in a disjointed way, you get a fragmented business process where things move slowly and frustratingly leading to:

- Delayed order processing

- Inventory discrepancies

- Duplicate data issue

- Slower cash conversion cycles

- Billing errors leading to payment disputes

- Increased workload and higher operational costs

ERP order to cash automation bridges the gap between these disjointed systems. How? By making sure that information flows seamlessly between departments and business systems used by them. Thanks to this automated information flow, instead of manually transferring data between platforms, information moves automatically, triggering the right actions at the right time.

Why does this matter? Because a streamlined order-to-cash workflow automation means:

- Reducing order-to-cash cycle time

- Faster payment collection

- Better customer experiences – with lesser payment disputes

- Significantly lower manual reconciliation of data

- Lower operational costs

- More accurate financial data for decision-making

Salesforce highlights the importance of a good O2C posture. Companies that adopted good O2C practices were found to be 81% more effective at ordermanagement.

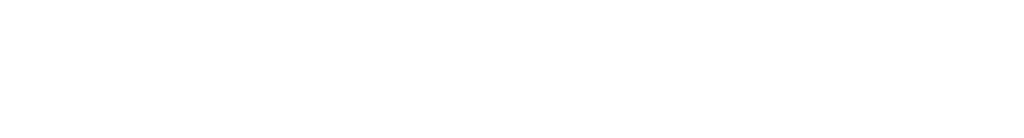

Common Challenges in Manual Order-to-Cash Processes

Gartner says that the worldwide ERP market grew by an impressive 13% in 2023. In the United States, the market size of ERP software was around 12.84 billion USD in 2024. Despite the high adoption rate of ERPs, businesses still reel from manual processes. Small businesses – specifically – have many manual processes despite working with an ERP software. One such process is O2C. Manual order to cash process is a starting point for all businesses.However, as businesses grow, such processes start becoming a hindrance. Manual O2C processes aren’t sustainable in the long run.

Data Silos and Duplicate Data Entry

If your Ecommerce platform isn’t tightly integrated with your ERP system, your team needs to manually re-enter order details received through the ecommerce platform. If the person who orders hasn’t ever bought from you, then you need to create a new customer information in the ERP.

So basically, you’re entering the same data to a different system. You’re bleeding valuable time.

Our client, US Tobacco, faced the same issue. Their WooCommerce store and SAP S/4 HANA ERP worked as separate entities. Data from one system had to be manually entered into the other. Click here to read the case study and learn how the company solved the issue.

Inaccurate Inventory Visibility

Without real-time synchronization, inventory levels in your eCommerce store rarely match what’s in your ERP. This leads to overselling, backorders, and disappointed customers.

Delayed Invoicing

When orders take days to process internally, invoices go out late—pushing your entire payment timeline further into the future and hurting your cash flow.

Payment Reconciliation Nightmare

Automation results in the creation of an audit trail that can trace invoices back to the actual order within seconds. When you don’t have an automated O2C process, your finance team spends its precious time manually matching incoming payments with the right invoices.

Limited Visibility

Without an integrated system, nobody has a complete view of where an order stands. Customer service can’t provide accurate information, and management lacks the insights needed for strategic decisions.

How ERP Order-to-Cash Automation Works

At its core, ERP automation for order processing creates a unified data ecosystem where information flows automatically between systems. Here’s how it typically works:

- Order Capture: Customer orders from any channel are automatically captured and validated

- Credit Management: Credit checks run automatically based on predefined rules

- Order Fulfillment: Warehouse receives accurate picking information

- Shipping: Shipping details flow back to the customer and into accounting

- Invoicing: Invoices generate automatically once shipment is confirmed

- Payment Processing: Incoming payments are matched to invoices

- Reporting: Management gains real-time visibility into the entire process

The key is eliminating manual handoffs between systems—replacing them with automated workflows that keep processes moving 24/7.

Essential Features of an Effective ERP Order-to-Cash Automation Solution

Integrating the systems contributing to your order to cash process requires careful use-case analysis. Not all integration solutions can address your pain points. Here are the essential features that we think should strictly be there in any ERP O2C integration solution:

Omnidirectional Data Synchronization

In the O2C process, the system where information originates might need the updated info from the system where the information travels to. Thus the originating system becomes the receiving one during the O2C workflow. This is why any good integration solution should support omnidirectional data flow. When inventory changes in your ERP, it should update in your eCommerce platform. When a customer updates their information, it should flow to your CRM.

Pre-Built Connectors for Key Systems

Choose the integration solution that offers user-friendly, prebuilt connectors for the systems your business uses. Custom integration can be costly, developer-dependent and unstable.

Intelligent Error Handling

What happens if the integration fails to carry the information of a new order from your ecommerce system to your ERP? How should it retry? How should it use the fail-safe methods? If everything fails, how should it notify you? A good order management automation platform takes these untoward scenarios into account and notifies you when the workaround fails.

Look For Flexible Integration Systems

Your ERP system adapts to your business logic, your CRM adapts to your business structure… Why should the O2C integration system be any different? Your automation solution should adapt to your business rules, not force you to change your processes to fit the software.

Opt For a Scalable System

Your automation system should be able to scale – without no performance degradation – as your business grows.

Challenges In Automating ERP Order To Cash

While ERP order to cash automation can bring dramatic efficiency to the entire order processing and inventory management processes, there are some challenges in implementing it:

Making Sure That Your ERP ‘Talks’ To Your Legacy Systems

This is not much of a challenge for businesses that are just starting up. However, legacy businesses using older systems might find it challenging to integrate all their legacy software and databases with modern ERP systems.

Our client Proveedora PGP faced a similar issue with the connector used to integrate their Shopify store with SAP Business One. The integration crashed frequently leading to manual reconciliation and error correction. Ultimately with APPSeCONNECT Shopify-SAP Business One connector, they were able to resolve the issue once and for all.

The Cost Factor:

A business can save money by opting for a cloud ERP. But integrating all the disjointed systems with the cloud ERP requires the expertise of trained and experienced engineers. And this experience comes at a cost.

Data Security Risk:

Connecting multiple systems handling your order processing, customer data and even financial data brings with it the risk of expanding your attack surface. Malicious actors can now have a single source to illegally access your sensitive data. Using a secure integration platform or handling API connections extremely carefully is a must.

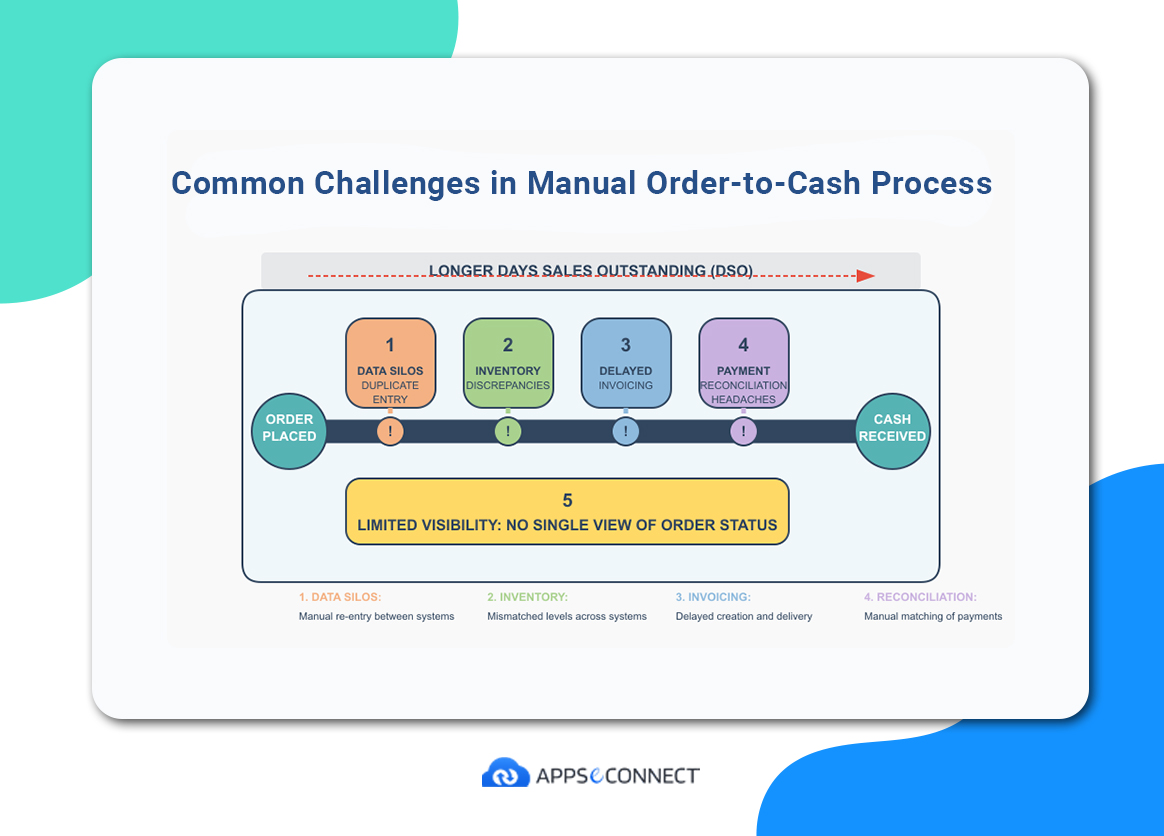

APPSeCONNECT – Turning O2C Chaos Into Competitive Advantage

There are many ways to connect your disjointed systems that are contributing to your order to cash workflow. The best among them are iPaaS-based solutions. These no-code/low-code integration solutions need little to no developer-handholding.

APPSeCONNECT stands out as a specialized iPaaS (Integration Platform as a Service) designed specifically for connecting business applications like ERPs, eCommerce platforms, and accounting systems.

Here’s how APPSeCONNECT helps in order-to-cash process improvement:

Seamless Multi-Channel Order Processing

Businesses usually have multiple sales channels – their own ecommerce stores, online marketplaces, physical showrooms and more. The APPSeCONNECT iPaaS platform can be connected with all of these disjointed channels making them work together seamlessly. Whether orders come from your website, marketplaces, or physical stores, APPSeCONNECT captures them all and routes them directly to your ERP system. This means no more manual order entry and significantly faster processing times.

Read our case study on Prestige Food and Wines, an Italian food importer supplying over 2,500 products to restaurants and hotels across the UK. Before APPSeCONNECT, they struggled with manual sales order entry between Magento and SAP Business One. After implementation, their orders flow automatically between systems—letting them focus on growing their business instead of copying and pasting orders. That’s a 100% uniformity in order processing.

Drag and Drop-Based Workflow Creation – With Pre-Built Connectors

Unlike expensive iPaaS solutions like Mulesoft that still rely on API-based integration, APPSeCONNECT democratizes order to cash automation workflow creation. With pre-built connectors and drag-drop based business logic creation, the entire O2C process can be automated and all the business systems in the process can be seamlessly connected without the need for any custom code. As a result, APPSeCONNECT is more user-friendly and flexible compared to MuleSoft.

Intelligent Product Handling

APPSeCONNECT handles complex product scenarios like variants, bundles, and configurable products. Our client, Henri Lloyd tackled this head-on, successfully managing multiple clothing variants between Shopify and SAP Business One. Their challenge: product variants in Shopify didn’t match parent items in SAP. APPSeCONNECT created intelligent mapping rules that matched everything perfectly—no more mismatched inventory or pricing.

Real-Time Inventory Synchronization

Nothing frustrates customers more than ordering a product only to find it’s out of stock. APPSeCONNECT eliminates this problem entirely.

For Prestige Food and Wines, efficient stock control became a game-changer. With thousands of perishable Italian food products, accurate inventory was critical. APPSeCONNECT provided real-time synchronization between their warehouse and online store, preventing stockouts and eliminating overselling.

Automated Invoice Generation

Once an order ships, APPSeCONNECT triggers automatic invoice creation in your ERP and accounting systems. Henri Lloyd saw all invoices automatically created in SAP with the correct customer information—no manual intervention required.

Scalability

The capabilities of APPSeCONNECT can be scaled as and when business grows. It’s a future proof iPaaS solution meant for businesses that will keep growing in the coming months. While Mulesoft does offer enterprise-grade scalability, it comes at the cost of added complexity.

| Did You Know? |

| APPSeCONNECT is 100% SOC2 and HIPAA compliant as well as GDPR friendly enabling businesses to stay compliant with stringent data security regulations. |

How to Get Started with APPSeCONNECT for Order-to-Cash Automation

Ready to transform your Order-to-Cash cycle? Here’s how to get started with APPSeCONNECT and create an automated order processing system

- Needs Assessment

First identify the systems associated with your O2C workflow. Assess what can be connected with your ERP system natively. For the rest, you will need APPSeCONNECT.

- Planning

Our integration engineers work with your team to plan for disruption-free integration architecture.

- Implementation

Use our pre-built connectors to establish the initial synergy between your O2C systems. Once all systems are integrated, match the workflow to match your business needs.

- Testing

Thoroughly test each process to ensure data flows correctly.

- Deploy To Production

It’s time now to go live and launch your tested order to cash automation platform.

APPSeCONNECT’s highly flexible platform makes it easy to adapt to your specific business requirements, with features like:

- Pre-built connectors for popular ERP and eCommerce systems

- Visual ProcessFlow designer for building custom workflows

- Real-time data synchronization

- Intelligent error tracking and handling

- Enterprise-grade security

North America clocks the highest number of iPaaS adoptions in the world. It’s time for your business to take the direction in the right direction with APPSeCONNECT iPaaS.

Take Control of Your Revenue Cycle Today

In today’s fast-paced business environment, slow, manual Order-to-Cash processes aren’t just inefficient—they’re a competitive disadvantage. While your team is busy with data entry, your competitors are investing in customer relationships and strategic growth.

APPSeCONNECT delivers the seamless integration and automation capabilities you need to speed up your revenue cycle, reduce errors, and improve cash flow—all while enhancing the customer experience.

APPSeCONNECT Vs Competitors:

| Feature | APPSeCONNECT | MuleSoft | Boomi | Jitterbit | Celigo |

| Pre-Built ERP & eCommerce Connectors | Extensive Library (Yes) | Broad & Deep (Yes) | Comprehensive (Yes) | Wide Range (Yes) | Vertical SaaS Focus (Yes) |

| Details | SMB/Mid-market focused, expanding. | Enterprise, vast ecosystem. | Large library, cloud & on-premise. | Good selection, adaptable. | SaaS ecosystems like NetSuite. |

| Low-Code Workflow Builder | Intuitive & Powerful (Yes) | Developer-Centric (Limited) | Low-Code Focus (Yes) | Low-Code Platform (Yes) | Low-Code, User-Friendly (Yes) |

| Details | Drag-and-drop, visual, user-friendly. | Code-based, some low-code tools. | Visual, user-friendly, orchestrations. | Visual designer, citizen integrators. | Business users, intuitive SaaS. |

| Scalability for Growing Business | Highly Scalable & Flexible (Yes) | Enterprise-Grade Scalability (Yes) | Scalable (Yes) | Scalable Architecture (Yes) | SaaS Ecosystem Scalability (Limited) |

| Details | Growth-focused, flexible deployment. | Massive scale, complex needs. | Resource adjustments for scale. | Cloud-native, scales with demand. | SaaS focused, broader scale limits. |

| Real-Time Data Sync | Robust Real-Time (Yes) | Real-Time & Batch (Yes) | Real-Time & Batch (Yes) | Real-Time & Batch (Yes) | Real-Time & Event-Driven (Yes) |

| Details | Efficient real-time sync. | Real-time and batch support. | Real-time and batch options. | Real-time and batch options. | Real-time, event-driven SaaS. |

| Total Cost of Ownership (TCO) | Competitive & Value-Driven | Higher TCO (Expensive) with too complex pricing structure | Higher Licensing. Complex pricing structure | Affordable & Accessible | Mid-Range |

| Details | Attractive SMB pricing, strong ROI. | High cost, large enterprise focus. | Expensive, tiered pricing. | Cost-effective, balanced price/features. | SaaS value reflects pricing. |

Like Henri Lloyd and over 500 other organizations worldwide, you can transform your Order-to-Cash process from a bottleneck into a competitive advantage.

Struggling with slow payments? See how APPSeCONNECT accelerates revenue cycles. Get a Free Trial Today.

Here’s Why APPSeCONNECT Is The Best Integration Platform for ERP O2C Automation

- Multichannel order processing

- Pre-built connectors and drag and drop-based workflow

- Real Time data processing

- End-to-end visibility into order processing, inventory and shipping

- Military-grade encryption

Frequently Asked Questions

There are several steps in the order to cash cycle – order placing, order processing, shipping, inventory management, invoice generation, cash receipt and more. ERP order-to-cash automation entails using software to streamline and automate these processes for maximum order to cash efficiency. This typically involves connecting your systems like ecommerce platform, inventory management platform etc. to your ERP system so that every aspect can be managed from a single window.

Manual O2C process leads to:

- Data silos

- Problems with keeping track of inventory levels leading to stock outs or overstocking

- Delayed invoicing

- Limited visibility into the order and shipping process

Above all, manual O2C leads to a dramatic decrease in customer satisfaction.

The key benefits of an automated order to cash process are:

- Reduced order to cash cycle time

- Faster order processing

- Dramatic reduction in manual data reconciliation – hence reduced cost

- Enhanced customer satisfaction